Risk Management

The University of Florida (UF) uses risk management to identify, assess, and prioritize risks in an effort to control, avoid, minimize, or eliminate the effects on its assets. University of Florida use risk managers to negotiate risk assumption, avoidance, retention, transfer, or any other strategies to appropriately manage and mitigate risk. Below are some of the ways that UF is using Risk Management to mitigate our risk as a university.

UF manages four traditional categories of loss exposures:

- Property: Both Tangible and Intangible.

- Liability: Civil and Statutory

- Personnel

- Net Income Loss Exposures: Reduction in Revenue or Increase in Expense

Enterprise risk management (ERM) is the process of identifying and addressing potential events that represent risks to the achievement of strategic objectives, or to opportunities to gain competitive advantage.

UF manages five enterprise risk loss exposures:

- Business Model Risks

- Reputation Risks

- Operating Model Risks

- Enrollment Supply Risks

- Compliance Risks.

Accidental losses can happen and there are methods in which to make these events more preventable. The more preventable an event, the less risk is involved since the occurrence can be mitigated.

Documenting The Risk

The process of documenting any risks that could keep an organization or program from reaching its objective. It’s the first step in any risk management process, which is designed to help companies understand and plan for potential risks.

Informal Risk Assessment: Meetings and Dialogues

Formal Risk Assessment: Enterprise Risk Management (ERM) and Compliance

- What are the exposures?

- Where are they?

- Who is responsible?

- How can we mitigate them?

- When should we act?

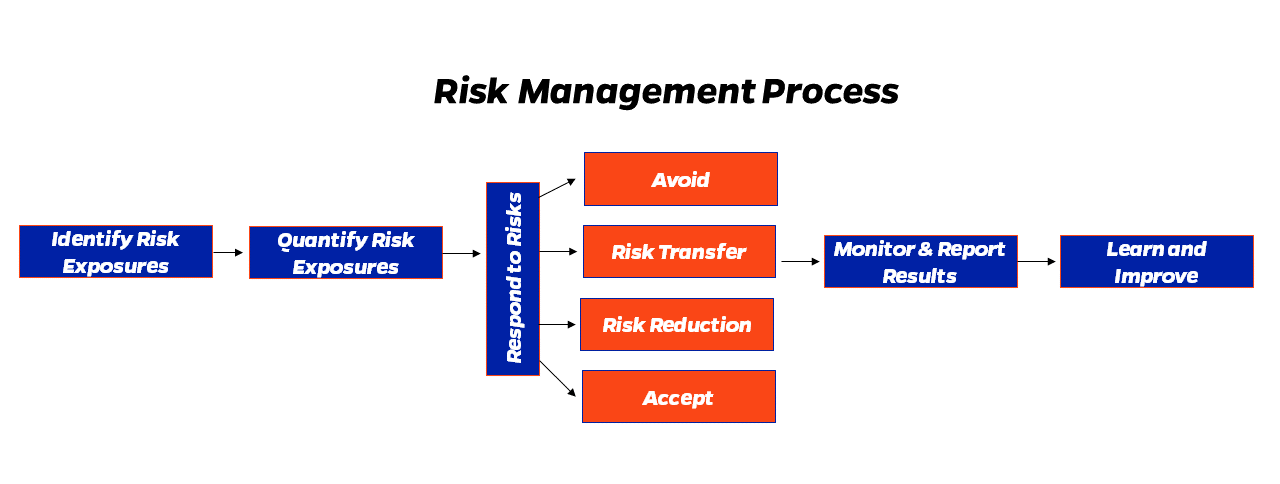

There Are Five Basic Steps of The Risk Management Process:

- Identifying the Risk:

The initial step in the risk management process is to identify the risks that UF is exposed to in its operating environment.

- Analyze and prioritize risks based on the likelihood or occurrence and potential impact:

Once a risk has been identified it needs to be analyzed to determine the scope of the risk.

Risks need to be ranked and prioritized.

A risk that may cause some inconvenience is rated lowly; risks that can result in catastrophic loss are rated the highest.

- Treat the Risk and Implement Strategies to Mitigate Risks:

Every risk needs to be eliminated or contained as much as possible. This is done by connecting with the experts of the field to which the risk belongs.

- Monitor and Review the Risk:

Qualitative Risk Assessment: Identifying threats (or opportunities), how likely they are to happen, and the potential impacts if they do.

Quantitative Risk Assessment: It is a formal and systematic method using measurable, objective data to determine an asset’s value, the probability of loss, and other associated risks.

- Learn and Improve the Process:

Create a new workflow that addresses the key issues.

At UF we believe that everyone is a risk manager, and our job is to provide service and support needed to succeed safely.